by Kelley Doerksen | Nov 2, 2023 | Estate Planning, Financial Planning, Tax Planning

Do you know what probate is? In this video, Kelley Doerksen, CFP® explains what it is as well as when and why it might be needed. You will also learn about some of the outcomes that happen whether you apply for it or not.

Watch the video here:

https://youtu.be/81NQR7jUZNQ

We are going to discuss probate – when and why it might be needed and some of the outcomes of obtaining probate or not.

Probate is simply the process of applying to the courts to validate the will of the deceased. The will does give the executor the authority to administer the estate, however probate can be really important to again, validate with certainty that the will is the final will of the deceased and the executor has full authority.

Many financial institutions will not allocate out assets according to a will alone, especially if there are no named beneficiaries; so for a non-registered account, etc. there often needs to be a process of going through probate in order for those institutions to feel confident that the residuals or the assets being provided are going to the proper beneficiaries and the executor has the authority to request this.

So, for some estates, probate is not necessary, but for many estates it is.

Probate also starts a period of time for a limitation where those who might want to challenge the validity of the will, will have the time and an end point with which to do that. If probate is not applied for, the limitation period never starts, and so therefore, it theoretically does not end either.

Probate fee planning can be an important component of your overall estate plan. In Alberta, of course, probate fees are insignificant, however in other provinces, namely Ontario and BC, probate fees can be quite significant.

Be careful when you are working with probate fee planning or your goal might be to eliminate probate fees in your estate because there can be unintended consequences for your estate and beneficiaries, by engaging in probate fee planning.

Probate fee planning should be part of your overall estate planning goals and objectives, and your financial planner can help you understand and maybe even project out what your outcomes would be by trying to accomplish your probate fee planning you have in mind; and perhaps provide you with some alternatives or other suggestions if the outcome is not what you intend.

Absolutely vital to estate planning, of course, is writing a valid will with a lawyer who understands your goals and objectives. Including your financial planner and involving them in the conversations with your lawyer can be beneficial in understanding by both parties and yourself how you would like to see your goals accomplished.

If you would like us to be involved, or have any questions about how your beneficiary designations or other goals and objectives for your estate needs are going to be met, please reach out to us and we are happy to help.

by Kelley Doerksen | Oct 24, 2023 | Estate Planning, Financial Planning, Tax Planning

Today we are sharing a charitable giving strategy that can be implemented as part of your overall estate plan.

Watch our video here:

https://youtu.be/uuMZK1wiAS0

This strategy involves donating life insurance policies and there are two primary methods of doing so.

The first way to do so is to purchase the life insurance policy with yourself as the owner as well as the insured, and name the charity that you would like the insurance policy to pay out to, as the beneficiary.

This method will provide you with a tax benefit at death. The benefit can be used in your year of death against your income for that year of death, up to 100% of your income in the year of death. As well, if the credits have not been used through in that year of death, credits can be used in the year previous. Again, up to 100% of income in the year prior to death.

A benefit of this method is that if you decide you would like to name a different charity as beneficiary, it is under your control to do so. All you need to do is fill out a beneficiary change form and make the adjustment. So you have a lot more flexibility with this method.

A second method for donating life insurance, is where you as the life insured are the insured on the policy, and the charity is the owner of the policy.

This method allows the charity to provide you with a tax receipt as you are paying premiums, and therefore, your benefit happens while living and helps you reduce your tax on your income while you are alive.

This strategy is beneficial for the charity; it also is beneficial for some clients who find that they need more tax benefit while they are alive, rather than the benefit to their estate, for a variety of reasons.

The downside to this strategy is that the charity remains owner of the policy, and you cannot change ownership of the policy to another charity. So, you need to be very confident that you have chosen a charity that you would like to support, and that they are going to use the proceeds of the policy in a manner that you deem suitable on your death. It can be a good idea to talk to the charity and have them write a letter of understanding for example, outlining that the use of the proceeds of the policy will be in line with what your goals and objectives are.

The benefit is that using that charity receipt while living can obviously help reduce your tax owing through your retirement (which is often when clients put this in place).

If you have any questions about or have any interest in learning about how using a life insurance policy to benefit charities can be suitable for you, please reach out.

by Kelley Doerksen | Sep 2, 2023 | Estate Planning, Tax Planning

A common question we often get from clients is how assets are taxed at death. Watch our latest video here:

https://youtu.be/V-IY0VnNaZU

Today we are going to touch on a few of the pieces of information that you need to know about different categories of assets and how they are taxed.

One thing that is important to note is that in Canada we do not have inheritance taxes, however some jurisdictions around the world do, and that may or may not apply to certain Canadian residents, depending on where assets are held.

We are going to talk specifically about Canadian resident, Canadian assets today. We are going to discuss Non-Registered Assets, Registered Accounts, and some things to be aware of with beneficiary designations on those accounts if applicable.

Many provinces and territories do apply probate fees to estates; and taxation for everybody, whether or not probate fees apply, is a really important topic to start thinking about for yourself and for your family.

On death, assets in a Non-Registered account are deemed disposed the day of death. And this will often trigger capital gains or capital losses, or both. And taxation on these gains or losses are going to be applied at the level of the estate of the individual that is deceased. Capital losses, if those are applicable, can actually be applied to any income in the year of death, and potentially other years, so speak to your accountant about that. Capital losses can be used against other forms of income, not just capital gains.

Registered accounts are eligible for beneficiaries to be designated. Many people choose to designate beneficiaries that will receive the proceeds of their registered account at death. If a rollover provision is available, such as to a spouse, there is no taxation that needs to be addressed at the time of the deceased’s passing, as the assets in the registered account will essentially rollover to the spouse at the time of death. If the beneficiary of the registered account is not the spouse or eligible for a rollover, the registered assets will still be provided to the beneficiary in full, however it is very important to note that taxation does still occur on the full value of the registered account, and at the level of the deceased.

For example, if the registered account, for round numbers is worth $100,000 on the date of death, and there are two beneficiaries for which the rollover does not apply – each beneficiary will receive $50,000, and the estate still needs to pay tax on the $100,000 of deemed income for the deceased. Keep that in mind when you apply your beneficiary designations to the registered account.

A Tax-Free Savings Account can have both a successor-holder named, which can only be one’s spouse, as well as contingent beneficiaries. It is not common that people consider adding contingent beneficiaries to a Tax-Free Savings Account if their spouse is named successor-holder already; however, we have seen many circumstances where one loses testamentary capacity later in life and their successor-holder is deceased (their spouse is deceased), and we can then no longer name or add beneficiaries to their Tax-Free Savings Account. So do consider this, and review your own designations for those accounts to ensure that your estate and beneficiary designations are up to date and where you would like them to be. Of course, a Tax-Free Savings Account does not have tax applied, so if beneficiary designations have been elected, the dollars in the Tax-Free Savings Account will be distributed accordingly with no taxation necessary at any point.

Estate planning is very complex and we have just touched on a couple of issues today. There is a lot more to it and all estate planning should be considered in the context of your goals and your objectives.

Please reach out to us, we are happy to connect you with a lawyer and answer any questions that we are able to help you with. Learn more about our estate planning services here.

by Kelley Doerksen | Aug 22, 2022 | Estate Planning

Navigating the estate settlement process is often an overwhelming task during an already difficult time. It can be challenging and time consuming, involving much coordination amongst your financial, legal, and tax advisors. Typically there are some common points of confusion or areas that clients have the most questions about.

Here are 10 basics of settling an estate, to help you understand what may be involved.

1. Multiple death certificates are helpful – some institutions require the original, even if it’s just to look at and send back to the executor.

2. Registered and TFSA accounts that have named beneficiaries or successor holders – beneficiaries will receive the proceeds of their entitlement prior to probate being granted in most cases.

3. Non-registered assets, corporate assets, and the sale of the deceased principal residence (amongst other things) will normally require probate granted before assets can be dispersed.

4. Tax must be accounted for at the estate level/deceased person’s level – beneficiaries do not typically pay tax on their inheritance.

- This can pose a problem if a registered investment account is named to beneficiaries who are not spouse or financial dependents of the deceased where a rollover may be used. Normally the full entitlement is sent to the named beneficiary, while tax must still be paid and managed at the estate level. It is important to ensure there will be money available to pay tax.

5. Assets are deemed “disposed” at the deceased’s date of death. Currently, a principal residence is not taxable. Registered investments, if no rollover is available and utilized are considered disposed and will be taxable as income on the deceased’s terminal tax return. Non-registered assets are also deemed disposed, and resulting capital gains or losses will need to be listed in the terminal return.

6. Unused capital losses can be used to reduce ANY income in the year of death, not just capital gains.

7. More than one tax return can be filed for the deceased, including the terminal return, and a “rights or things” return. An accountant can determine if this is necessary or beneficial.

8. Executors normally have a right to compensation and may or may not wish to take this. Finalizing an estate can be substantial work.

9. A clearance certificate should always be requested from CRA once taxes have been paid – in many cases, distributions to residual beneficiaries are best left until this has been issued.

10. Using an estate management system, such as Cadence, can save executors time and ensure nothing is missed when settling an estate.

Your Financial Advisor and other professionals are here to help you through the process. If you have questions about the estate settlement process, please contact us.

You can also find more information about our estate planning services here.

by Kelley Doerksen | Jun 20, 2022 | Estate Planning

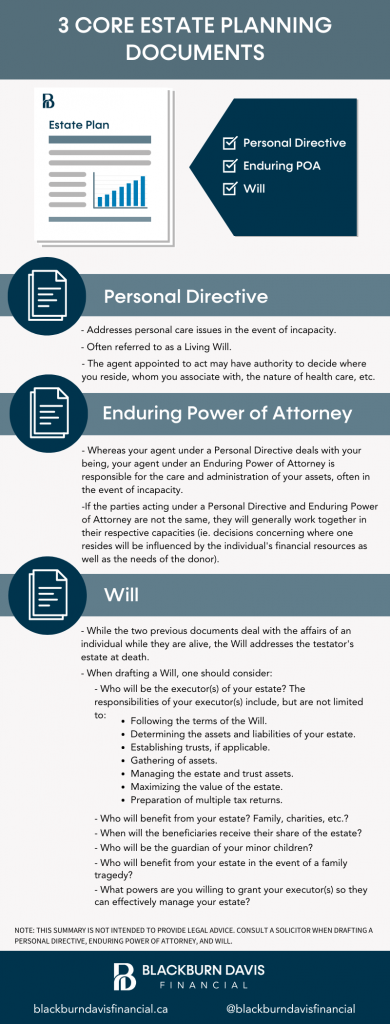

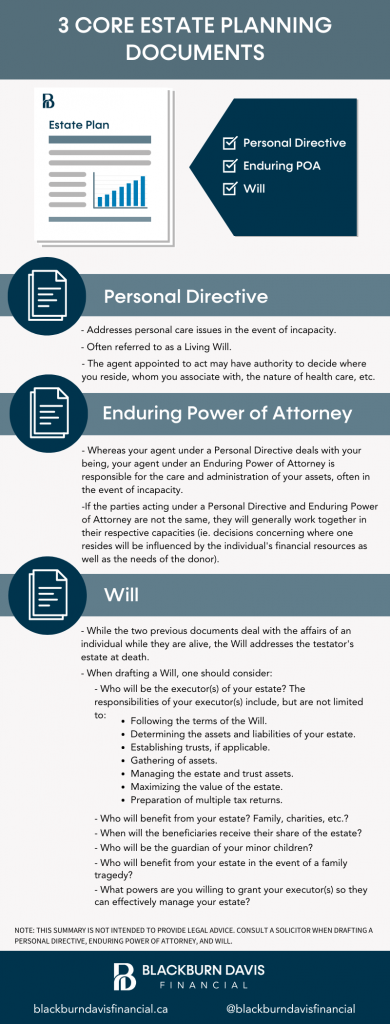

Estate planning ensures that if you are physically or mentally incapacitated, your affairs will be managed in a manner that you have prescribed and upon your death, your estate will be distributed according to your instructions.

Here is a brief overview of the three core estate planning documents you may need.

PERSONAL DIRECTIVE

This document addresses personal care issues in the event of incapacity.

It is often referred to as a Living Will.

The agent appointed to act may have the authority to decide where you reside, whom you associate with, the nature of health care, etc.

ENDURING POWER OF ATTORNEY

Whereas your agent under a Personal Directive deals with your being, your agent under an Enduring Power of Attorney is responsible for the care and administration of your assets, often in the event of incapacity.

If the parties acting under a Personal Directive and Enduring Power of Attorney are not the same, they will generally work together in their respective capacities (i.e. decisions concerning where one resides will be influenced by the individual’s financial resources as well as the needs of the donor).

WILL

While the two previous documents deal with the affairs on an individual while they are alive, the Will addresses the testator’s estate at death.

When drafting a Will, one should consider;

- Who will be the executor(s) of your estate? The responsibilities of your executor(s) include, but are not limited to:

-

- Following the terms of the Will.

- Determining the assets and liabilities of your estate.

- Establishing trusts, if applicable.

- Gathering of assets.

- Managing the estate and trust assets.

- Maximizing the value of the estate.

- Preparation of multiple tax returns.

- Who will benefit from your estate? Family, charities, etc.?

- When will the beneficiaries receive their share of the estate?

- Who will be the guardian of your minor children?

- Who will benefit from your estate in the event of a family tragedy?

- What powers are you willing to grant your executor(s) so they can effectively manage your estate?

Please reach out to us if you have questions about the estate planning process. We are here to help identify your estate planning needs, and to develop a strategy and plan to meet those needs. We will also coordinate with your lawyer and accountant to ensure your plan is implemented.

NOTE: THIS SUMMARY IS NOT INTENDED TO PROVIDE LEGAL ADVICE. CONSULT A SOLICITOR WHEN DRAFTING A PERSONAL DIRECTIVE, ENDURING POWER OF ATTORNEY, AND WILL.

by Kelley Doerksen | Feb 28, 2022 | Estate Planning, Tax Planning

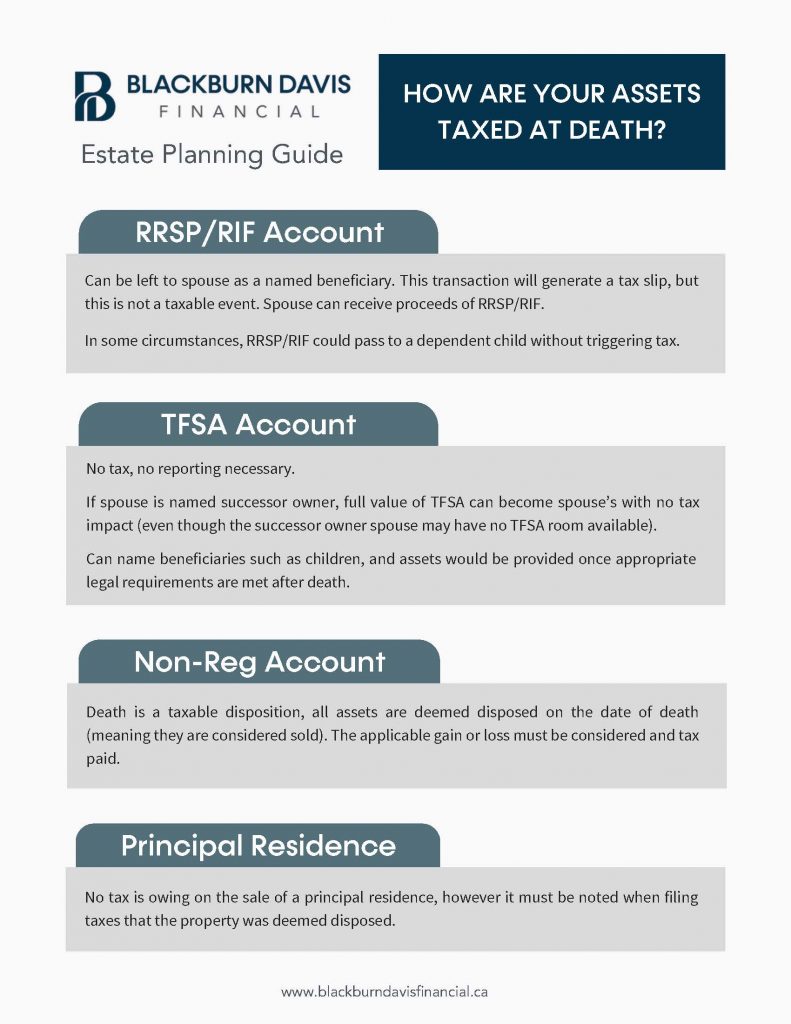

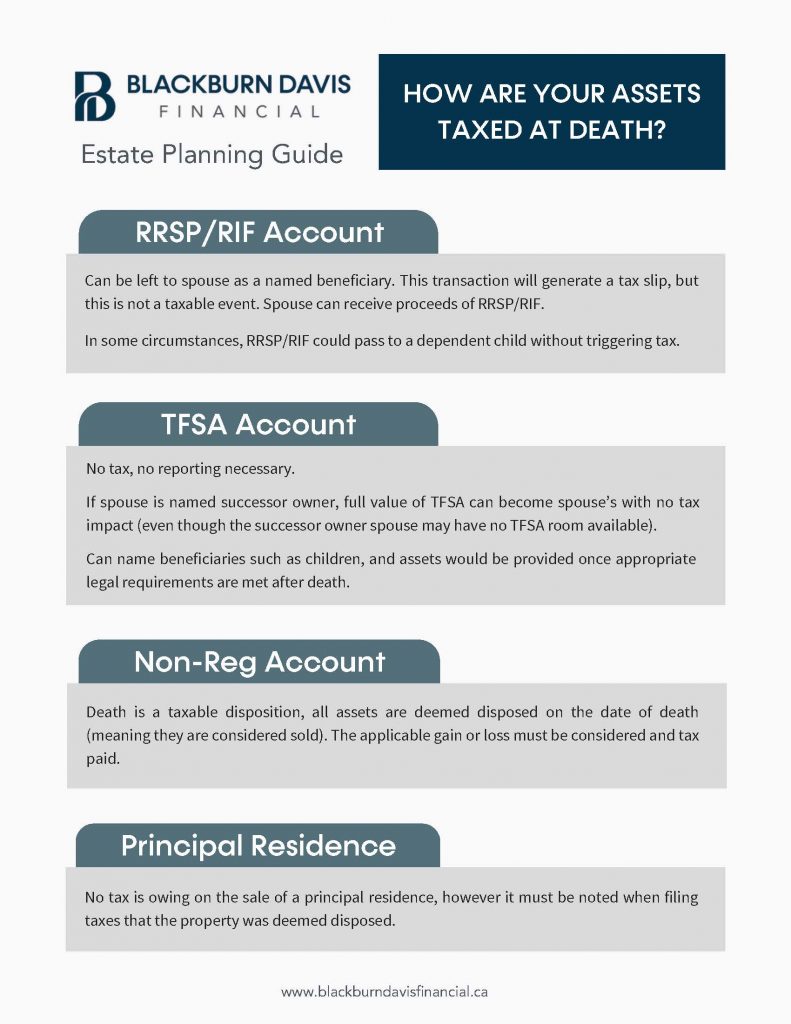

One of the objectives of estate planning is to review and minimize potential taxes on your remaining assets.

Lets review how some common assets (RRSP/RIFs, TFSAs, Non-Registered Accounts, and Principal Residences) are taxed upon death.

RRSP (Registered Retirement Savings Plan) / RIF (Retirement Income Fund)

The accounts can be left to a spouse as a named beneficiary. This transaction will generate a tax slip, but this is not a taxable event. The spouse can receive the proceeds of the RRSP/RIF.

In some circumstances, the RRSP/RIF could also pass to a dependent child without triggering tax.

TFSA (Tax-Free Savings Account)

No tax and no reporting is necessary.

If a spouse is named as the successor owner, the full value of the TFSA can become the spouse’s with no tax impact (even if the successor owner spouse may have no TFSA room available).

You can name beneficiaries such as children, and the assets would be provided once appropriate legal requirements are met after death.

Non-Registered Account

Death is a taxable disposition and all assets are deemed disposed on the date of death (meaning they are considered sold). The applicable gain or loss must be considered and tax paid.

Principal Residence

No tax is owing on the sale of a principal residence, however it must be noted when filing taxes that the property was deemed disposed.

If you have a question pertaining to your specific financial situation or need some assistance with estate planning, please reach out and our financial advisors would be happy to assist you. You can learn more about the estate planning services we provide here.