One of the objectives of estate planning is to review and minimize potential taxes on your remaining assets.

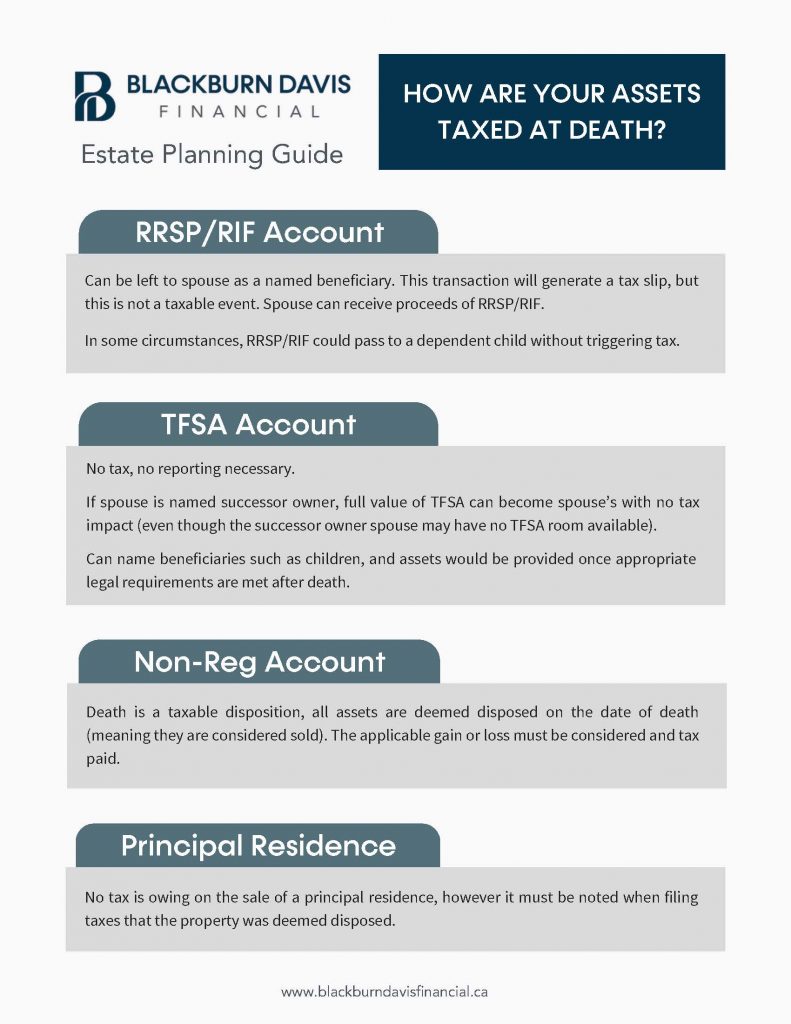

Lets review how some common assets (RRSP/RIFs, TFSAs, Non-Registered Accounts, and Principal Residences) are taxed upon death.

RRSP (Registered Retirement Savings Plan) / RIF (Retirement Income Fund)

The accounts can be left to a spouse as a named beneficiary. This transaction will generate a tax slip, but this is not a taxable event. The spouse can receive the proceeds of the RRSP/RIF.

In some circumstances, the RRSP/RIF could also pass to a dependent child without triggering tax.

TFSA (Tax-Free Savings Account)

No tax and no reporting is necessary.

If a spouse is named as the successor owner, the full value of the TFSA can become the spouse’s with no tax impact (even if the successor owner spouse may have no TFSA room available).

You can name beneficiaries such as children, and the assets would be provided once appropriate legal requirements are met after death.

Non-Registered Account

Death is a taxable disposition and all assets are deemed disposed on the date of death (meaning they are considered sold). The applicable gain or loss must be considered and tax paid.

Principal Residence

No tax is owing on the sale of a principal residence, however it must be noted when filing taxes that the property was deemed disposed.

If you have a question pertaining to your specific financial situation or need some assistance with estate planning, please reach out and our financial advisors would be happy to assist you. You can learn more about the estate planning services we provide here.